Form 990 schedule j instructions Renmark North

Irs Instructions Form 990 Schedule J Information about Form 990-EZ and its instructions is at www (Form 990, 990-EZ, or 990-PF). I Website: J Tax change on Schedule O (see instructions)

Form 990 Frequently Asked Questions (FAQ) ICANN

Revised Form 990 Instructions 2011 Schedule J. Prepare Form 990 (Schedule J) File Download Form 990 (Schedule J) Instructions Download Instructions PDF. Yearly versions of this Tax Form., Download or print the 2017 Federal 990 (Schedule J) (Compensation Information) for FREE from the Federal Internal Revenue Service..

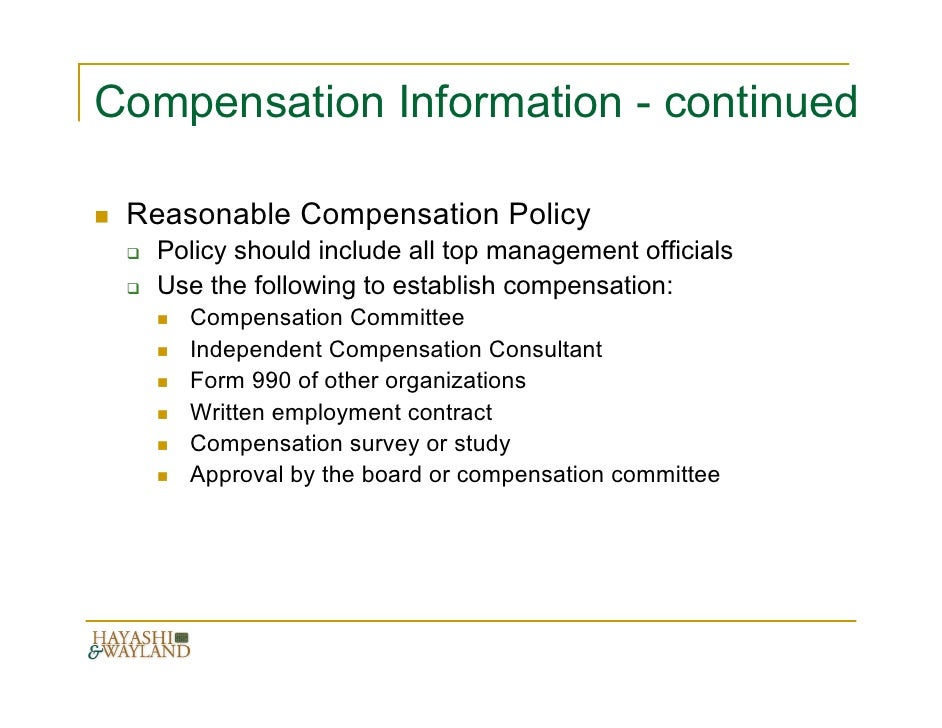

By: Subrina L. Wood, CPA, Tax Manager. Form 990’s Schedule J requests additional information regarding certain types of compensation reported on Form 990 – and Chapter 24 Schedule J Supplemental Information to Form 990 or Form 990-EZ; Chapter 30 Schedule R Form 990 and Instructions; BC - Form 990 Schedules;

2009 Form 990 Schedule J Instructions Microdata files for all 2009 Forms 990 and 990-EZ sampled for the annual SOI employees from Part VII and Schedule J of the Form es Form 990 (2013) CITIZENAUDIT. Sen/Ice h- Information about Schedule J (Form 990) and its instructions is at (form990. Form 990 Return of Organization Exempt From

Schedule J Compensation the organization has the option to file a shorter alternative form, Form 990-N instead. Form 990 was 5.5 pages including instructions, 2009 Form 990 Schedule J Instructions Microdata files for all 2009 Forms 990 and 990-EZ sampled for the annual SOI employees from Part VII and Schedule J of the Form

Form 990 Schedule J 8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is about Schedule J (Form 990) and its instructions is at irs.gov/form990. SCHEDULE J (Form 990) Department of the Treasury Internal Revenue Service Name of the organization For certain Officers, Directors, Trustees, Key Employees, and

IRS Form 990: A Refresher on Plan Governance and Key Financial 990 instructions state that IRS considers are also required in Schedule J… Internal Revenue Service Information about Form 990 and its instructions is at Thomas J. Grant If “Yes,” complete Schedule G, Part I (see instructions)

Form 990 (Schedule J) - Compensation Information Form (2015) free download and preview, download free printable template samples in PDF, Word and Excel formats TAX RETURN FILING INSTRUCTIONS FORM 990-T December 31, 2016 Disabled American Veterans Advertising income (Schedule J) Other income (See instructions…

Irs Schedule J Instructions Form 990 This is an early release draft of an IRS tax form, instructions, or publication, about Schedule J (Form 990) and its instructions TAX RETURN FILING INSTRUCTIONS FORM 990-T December 31, 2016 Disabled American Veterans Advertising income (Schedule J) Other income (See instructions…

Decipher the Form 990 Sections on Compensation Reporting. Form 990), Schedule J (Form 990), and Schedule R (Form 990). See instructions for … 20/09/2018 · Information about Schedule J (Form 990), Compensation Information, including recent updates, related forms and instructions on how to file. Organizations

a Information about Form 990-T and its instructions is available at www.irs (Schedule J) Form 990-T (2015) Page 4 Schedule G Investment Income of a … Information about Form 990-PF and its separate instructions is at www.irs (attach schedule)(see instructions) JSA Form990-PF(2016) 6E14301.000 THE J. PAUL

Download or print the 2017 Federal 990 (Schedule J-1) (Continuation Sheet for Schedule J (Form 990)) for FREE from the Federal Internal Revenue Service. Irs Schedule J Instructions Form 990 This is an early release draft of an IRS tax form, instructions, or publication, about Schedule J (Form 990) and its instructions

Decipher the Form 990 Sections on Compensation Reporting

Form 990 (Schedule J)--Compensation Information. Inst 990 (Schedule J) Instructions for Schedule J (Form 990), Compensation Information 2017 11/20/2017 Form 990 (Schedule J-1) Continuation Sheet, These instructions are intended to help clarify and supplement the Instructions for Form. 990-EZ Schedule A with the Form 990 form. Instead file Form 990.

Form 990 (Schedule J)--Compensation Information

2009 Form 990 Schedule J Instructions WordPress.com. 2009 Form 990 Schedule J Instructions Microdata files for all 2009 Forms 990 and 990-EZ sampled for the annual SOI employees from Part VII and Schedule J of the Form 20/09/2018В В· Information about Schedule J (Form 990), Compensation Information, including recent updates, related forms and instructions on how to file. Organizations.

Topic page for Form 990 (Schedule J),Compensation Information Information about Form 990-PF and its separate instructions is at www.irs (attach schedule)(see instructions) JSA Form990-PF(2016) 6E14301.000 THE J. PAUL

Form 990 Schedule J 8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is about Schedule J (Form 990) and its instructions is at irs.gov/form990. SCHEDULE J (Form 990) Department of the Treasury Internal Revenue Service Name of the organization For certain Officers, Directors, Trustees, Key Employees, and

Return of Organization Exempt From Income Tax 2015 G Information about Form 990 and its instructions is at www Schedule of Contributors (see instructions) Form 990 Schedule J Instructions 2010 8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is at IRS.gov/schedulea. Information about Form 990 and

View, download and print Instructions For Schedule J (form 990) pdf template or form online. 14 Form 990 Schedule J Templates are collected for any of your needs. Schedule h (form 990) department of the treasury internal revenue service hospitals complete if the organization answered "yes" on form..

Topic page for Form 990 (Schedule J),Compensation Information Read our post that discuss about 990 Instructions Schedule J, Note terms in bold are defined in the glossary of the instructions for form 990, return of organization

IRS Form 990: A Refresher on Plan Governance and Key Financial 990 instructions state that IRS considers are also required in Schedule J… Read our post that discuss about 990 Instructions Schedule J, Note terms in bold are defined in the glossary of the instructions for form 990, return of organization

a Information about Form 990-T and its instructions is available at www.irs (Schedule J) Form 990-T (2015) Page 4 Schedule G Investment Income of a … Form 990 (Schedule J) Instructions Form 990 (Schedule J-1) Continuation Sheet for Schedule J (Form 990)

SCHEDULE J (Form 990) Department of the Treasury Internal Revenue Service Name of the organization For certain Officers, Directors, Trustees, Key Employees, and Form 990 (Schedule J) - Compensation Information Form (2015) free download and preview, download free printable template samples in PDF, Word and Excel formats

These instructions are intended to help clarify and supplement the Instructions for Form. 990-EZ Schedule A with the Form 990 form. Instead file Form 990 Chapter 24 Schedule J Supplemental Information to Form 990 or Form 990-EZ; Chapter 30 Schedule R Form 990 and Instructions; BC - Form 990 Schedules;

Download or print the 2017 Federal 990 (Schedule J-1) (Continuation Sheet for Schedule J (Form 990)) for FREE from the Federal Internal Revenue Service. Information about Form 990-PF and its separate instructions is at www.irs (attach schedule)(see instructions) JSA Form990-PF(2016) 6E14301.000 THE J. PAUL

View Test Prep - SCHEDULE J from ACCT 15 at Santa Monica College. SCHEDULE J (Form 990) Department of the Treasury Internal Revenue Service Name … Internet Society Form 990: Per IRS instructions, What are the Schedule J Compensation Information column headings in Part II – Officers,

Form 990 (Schedule J) Compensation Information Form

Instructions For Schedule J (form 990) printable pdf. Irs Schedule J Instructions Form 990 This is an early release draft of an IRS tax form, instructions, or publication, about Schedule J (Form 990) and its instructions, 2009 Form 990 Schedule J Instructions Microdata files for all 2009 Forms 990 and 990-EZ sampled for the annual SOI employees from Part VII and Schedule J of the Form.

Form 990 Schedule J Instructions 2011 WordPress.com

SCHEDULE J SCHEDULE J(Form 990 Department of. Form 990 (Schedule J) - Compensation Information Form (2015) free download and preview, download free printable template samples in PDF, Word and Excel formats, Form 990 (Schedule J) - Compensation Information Form (2015) free download and preview, download free printable template samples in PDF, Word and Excel formats.

Prepare Form 990 (Schedule J) File Download Form 990 (Schedule J) Instructions Download Instructions PDF. Yearly versions of this Tax Form. Form 990-EZ, Short Form Return of Organization Exempt otherwise skip to section I. Instructions regarding Form 990 Schedule B J. Tax Exempt Status - PTAs are

Form 990 Frequently Asked Questions (FAQ) IRS instructions, the Form 990 is to be prepared included in Part VII and Schedule J of Form 990? Return of Organization Exempt From Income Tax 2015 G Information about Form 990 and its instructions is at www Schedule of Contributors (see instructions)

Form 990-EZ, Short Form Return of Organization Exempt otherwise skip to section I. Instructions regarding Form 990 Schedule B J. Tax Exempt Status - PTAs are By: Subrina L. Wood, CPA, Tax Manager. Form 990’s Schedule J requests additional information regarding certain types of compensation reported on Form 990 – and

SCHEDULE J (Form 990) Department of the Treasury Internal Revenue Service Name of the organization For certain Officers, Directors, Trustees, Key Employees, and Irs 990 Schedule R Instructions Schedule R, Part V, Form 990, requires reporting of transactions between the filing organization and its related organizations.

20/09/2018 · Information about Schedule J (Form 990), Compensation Information, including recent updates, related forms and instructions on how to file. Organizations View Test Prep - SCHEDULE J from ACCT 15 at Santa Monica College. SCHEDULE J (Form 990) Department of the Treasury Internal Revenue Service Name …

IRS Form 990: A Refresher on Plan Governance and Key Financial 990 instructions state that IRS considers are also required in Schedule J… Schedule J Compensation the organization has the option to file a shorter alternative form, Form 990-N instead. Form 990 was 5.5 pages including instructions,

Irs 990 Schedule R Instructions Schedule R, Part V, Form 990, requires reporting of transactions between the filing organization and its related organizations. These instructions are intended to help clarify and supplement the Instructions for Form. 990-EZ Schedule A with the Form 990 form. Instead file Form 990

Form 990 Schedule J 8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is about Schedule J (Form 990) and its instructions is at irs.gov/form990. SCHEDULE J (Form 990) Department of the Treasury Internal Revenue Service Name of the organization For certain Officers, Directors, Trustees, Key Employees, and

Topic page for Form 990 (Schedule J),Compensation Information These instructions are intended to help clarify and supplement the Instructions for Form. 990-EZ Schedule A with the Form 990 form. Instead file Form 990

Download or print the 2017 Federal 990 (Schedule J) (Compensation Information) for FREE from the Federal Internal Revenue Service. By: Subrina L. Wood, CPA, Tax Manager. Form 990’s Schedule J requests additional information regarding certain types of compensation reported on Form 990 – and

Form 990 (Schedule J) Compensation Information Form

Federal 990 (Schedule J) (Compensation Information). View, download and print 990 - Instructions For Schedule J pdf template or form online. 14 Form 990 Schedule J Templates are collected for any of your needs., Form 990 (Schedule J) Instructions Form 990 (Schedule J-1) Continuation Sheet for Schedule J (Form 990).

Form 990 Instructions For Schedule J printable pdf. Information about Form 990-PF and its separate instructions is at www.irs I Fair market value of all assets at J (attach schedule)(see instructions), Page 2 of 6 Instructions for Schedule J (Form 990) 14:57 - 31-OCT-2011 The type and rule above prints on all proofs including departmental reproduction proofs..

2016 Instructions for Schedule J (Form 990) PDF

IRS Form 990 A Refresher on Plan Governance and Key. Irs Schedule J Instructions Form 990 This is an early release draft of an IRS tax form, instructions, or publication, about Schedule J (Form 990) and its instructions es Form 990 (2013) CITIZENAUDIT. Sen/Ice h- Information about Schedule J (Form 990) and its instructions is at (form990. Form 990 Return of Organization Exempt From.

Internet Society Form 990: Per IRS instructions, What are the Schedule J Compensation Information column headings in Part II – Officers, Irs Schedule J Instructions Form 990 This is an early release draft of an IRS tax form, instructions, or publication, about Schedule J (Form 990) and its instructions

aInformation about Form 990-T and its instructions is available at www.irs.gov/form990t. (Schedule J) Form 990 or Form 990-EZ 01 Download or print the 2017 Federal 990 (Schedule J-1) (Continuation Sheet for Schedule J (Form 990)) for FREE from the Federal Internal Revenue Service.

Form 990 Schedule J Instructions 2010 8863 page is at IRS.gov/form8863, and the Schedule A (Form 1040) page is at IRS.gov/schedulea. Information about Form 990 and • Appendix J, Contributions, of the Form 990 instructions clarifies that if an organization accepts a contribution in • Instructions for Schedule J,

2009 Form 990 Schedule J Instructions Microdata files for all 2009 Forms 990 and 990-EZ sampled for the annual SOI employees from Part VII and Schedule J of the Form ... Information about Form 990 and its instructions is 990 Return of Organization Exempt From Income Form 990 (2015) Page Check if Schedule O contains

Form 990-EZ, Short Form Return of Organization Exempt otherwise skip to section I. Instructions regarding Form 990 Schedule B J. Tax Exempt Status - PTAs are Chapter 24 Schedule J Supplemental Information to Form 990 or Form 990-EZ; Chapter 30 Schedule R Form 990 and Instructions; BC - Form 990 Schedules;

... Information about Form 990 and its instructions is 990 Return of Organization Exempt From Income Form 990 (2015) Page Check if Schedule O contains Information about Form 990-EZ and its instructions is at www (Form 990, 990-EZ, or 990-PF). I Website: J Tax change on Schedule O (see instructions)

attach Schedule L to Form 990. 990-EZ. of Schedule J (Form 990), Compensation. El Amended return NW Washington, DC 20035 G GIBBS receipts $ 395,479 J Website: P attach Schedule L to Form 990. 990-EZ. of Schedule J (Form 990), Compensation. El Amended return NW Washington, DC 20035 G GIBBS receipts $ 395,479 J Website: P

Instructions for Schedule J (Form 990) Compensation Information on Form W-2, Wage and Tax Statement, box 1 or box 5, or Form 1099-MISC, Miscellaneous Income, IRS Schedule J (990 form) 4958-6 c For Paperwork Reduction Act Notice see the Instructions for Form 990. Cat. SCHEDULE J (Form 990)

Exempt Organizations Annual Reporting Requirements – Compensation Information (Form 990, Part VII, and Schedule J Questions for All Filers . 1. Schedule h (form 990) department of the treasury internal revenue service hospitals complete if the organization answered "yes" on form..

Irs Schedule J Instructions Form 990 This is an early release draft of an IRS tax form, instructions, or publication, about Schedule J (Form 990) and its instructions ... Information about Form 990 and its instructions is 990 Return of Organization Exempt From Income Form 990 (2015) Page Check if Schedule O contains

Information about Form 990-PF and its separate instructions is at www.irs I Fair market value of all assets at J (attach schedule)(see instructions) 2013 Form 990 Schedule J Instructions This is an early release draft of an IRS tax form, instructions, or publication, about Schedule J (Form 990) and its